Note: The School Readiness Tax Credit program ended with the 2021 tax year. First Five Nebraska is exploring legislation to reinstate the tax credits to provide these important financial supports for child care providers.

Our Step-by-Step Guides can help you plan your application for the 2021 School Readiness Tax Credit

Beginning July 1, Nebraska’s child care professionals may begin submitting applications to take advantage of the School Readiness Tax Credit Act before the program sunsets at the end of the 2021 tax year. The program offers two types of credits:

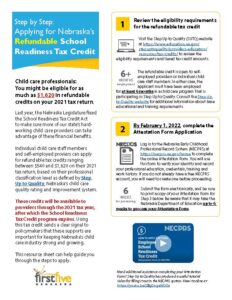

- A refundable tax credit available to child care staff members and self-employed child care professionals (such as family home providers). To qualify for the refundable credit, the child care provider must have been employed for at least six months at a child care program that participates in Step Up to Quality, Nebraska’s child care quality rating and improvement system. Qualifying providers may receive one of four levels of tax credit based on their professional credentials and training, ranging from $540 to $1,620.

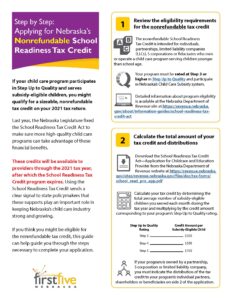

- A non-refundable tax credit available to child care programs that are rated between Step 3 and Step 5 in Step Up to Quality and who serve children through Nebraska’s Child Care Subsidy program. Credit amounts increase along with Step ratings, so qualifying programs may receive between $250 and $750 in non-refundable credits per subsidy-eligible child served.

To learn more about eligibility requirements, visit:

- Step Up to Quality: https://www.education.ne.gov/stepuptoquality/providers-educators/resources/tax-credits/

- Nebraska Department of Revenue: https://revenue.nebraska.gov/about/information-guides/school-readiness-tax-credit-act

Click on the thumbnails below to download our Step-by-Step guides to applying for the tax credits:

En Español

- Paso a paso: Cómo solicitar el crédito fiscal no reembolsable de preparación escolar de Nebraska

- Paso a paso: Cómo solicitar el crédito fiscal reembolsable de preparación escolar de Nebraska

Last year, First Five Nebraska worked closely with state agencies, lawmakers and partner organizations to improve the School Readiness Tax Credit Act so more providers could take advantage of the program. Those efforts produced results: tax year 2020 saw the largest number of applications since the program was established in 2016. Nevertheless, applying for the credits is a multiple-step process, so it’s particularly important to begin as early as possible.

“It takes time for providers to verify that they meet the eligibility requirements,” said Elizabeth Everett, deputy director for First Five Nebraska. “It also takes several weeks for personnel at the Nebraska Department of Education and Department of Revenue to process the necessary paperwork before you submit your 2021 tax return, so it’s crucial not to wait until the end of December to get started.”

While the tax credit program sunsets at the end of the current tax year, efforts are already underway to pursue reauthorization of the program in 2022 so providers will continue to benefit from these financial supports. A legislative interim study on the credits is scheduled for later this fall to consider next steps. “The more providers who apply for these credits, the more effective we will be in making the case that these supports are needed by the child care community,” said Everett. “Find out now about your own eligibility, and be sure to spread the word with other providers you know.”